travel nurse tax home parents house

Using someone elses address isnt a tax home. If you return home at the end of your shift you cannot deduct miles andor meals as tax free per diem stipends.

Home Town Season Six The Hanna House Laurel Mercantile Co

Tax homes tax-free stipends hourly wages bonuses benefits housing and per diem reimbursement are all factors to consider when understanding your travel nursing pay and taxes.

. 1The new job duplicates your living costs. Confusion about the distinction between a tax home and a permanent residence often leads to these common. Instead of looking at the primary place of incomebusiness it allows the tax home to default fall back on the permanent residence.

You have living expenses at your main home that you duplicate because your. Now that we have made the distinction between indefinite work and temporary work and we have discussed how to maintain temporary status as a travel nurse we can move on to our discussion about how to maintain a legitimate tax home. Experience benefits opportunity to.

These reimbursements do not count as taxable income as long as they are provided while youre working outside of your tax home. Its where you maintain a livable residence. Agency-placed housing may offer you better housing options than what you can afford with the housing stipend.

There is no possibility of negotiating a higher bill rate based on a particular travel nurses salary history or work experience. For many travel nurses their tax home is their permanent residence the place where their drivers license is registered. For true travelers as defined above the tax rules allow an exception to the tax home definition.

Any phone Internet and computer-related expensesincluding warranties as well as apps and other. It is what you do at the end of your shift which determines if the assignment is far enough to qualify as a Travel Assignment. According to Publication 463 the requirements are as follows.

Ask A Travel Nurse. The job post will list a compensation in the description. One of the requirements of maintaining a tax home is that the traveler must have significant expenses in maintaining their principal residence When one rents out their home the.

If your friend has a 2 bedroom apartment and pays 500mo and your parents have a 3 bedroom house at 1000mo you can rightly calculate 5002 rooms 250 10003 rooms 333average them and pay somewhere between 200-300mo and youre good. In California Tax-Free Stipends can be as much as 1800 per week for housing in San Francisco and 500 per week for Meals and. 2You still work in the tax home area as well.

Joseph Smith EAMS Tax an international taxation master and founder of Travel Tax explains that in addition to their base pay most travel nurses can reasonably expect to see 20-30000 of non-tax. When youre working as a travel therapist having a tax home allows you to take housing and per diem stipends provided by travel therapy companies without having to pay taxes on them due to the stipends being a reimbursement for costs incurred at the travel. Allnurses is a Nursing Career Support site.

Everyone has to have somewhere to live and something to eat but since that financial burden may be double for traveling workers the cost is alleviated through. Yes you may lose 4000 to 6000 in tax savings a year but the cost and time of maintaining your tax home may exceed that amount. The following nine tips can make filing your travel nurse taxes easier save you money and help you avoid future tax liability.

Posted on July 6 2016 May 20 2021 by The Gypsy Nurse Staff. Tax break 3 Professional expenses. Reimbursements are business-related expenses that you have paid for out-of-pocket that your employer pays you back for.

Tax deductions for travel nurses also include all expenses that are required for your job. Since 1997 allnurses is trusted by nurses around the globe. Why tax homes are so important.

To be your tax home it must meet at least 2 of these. This puts it in-line or above the national median wage for Registered Nurses with 5-9 years of experience. You perform part of your business in the area of your main home and use that home for lodging while doing business in the area.

So all compensation will be taxed including housing. While working as a travel nurse youll receive a compensation package typically called a per diem andor a stipend that reimburses expenses like food and housing expenses. You have not abandoned your tax home.

Causing you to pay for two places to live. The 3 Factor Threshold Test. Travel Nursing Pay Qualifying for Tax-Free Stipends.

This is typically done in the form of an expense report. Make sure you qualify for all non-taxed per diems. This can happen try finding a furnished short-term lease that includes utilities during the holidays in a safe neighborhood of Manhattan for 1600 per month.

There are a handful of important tax advantages to be aware of as a travel nurse primarily in the form of stipends and reimbursements. The IRS requires travel nurses to satisfy three requirements to do this. Distance is not the only qualifier for Travel Nursing stipends.

If maintaining your tax home is too much work and you prefer to go from assignment to assignment without returning home do it. Even in difficult economic times the fully blended rate for the average travel nursing contract is still somewhere between 37hour-43hour. Basically a tax home is your primary residence where you live andor work.

What you are currently making will determine whether a particular assignment pays more or less. This job guarantees 36 hours per week which comes out to a total pay 2232 week. Simply put your tax home is the region where you earn most of your nursing income.

The total pay also known as the blended rate is then calculated based on the number of guaranteed hours per week. Travel nurses may consider renting their home while on travel assignments but this could kill your tax home status. Deciphering the travel nursing pay structure can be complicated.

Having a tax home allows you to save on taxes for certain travel expenses tax deductible expenses when youre away from your tax home. The only condition to qualify for Tax-Free income is that the traveler must be working in a state that is not their tax home. This example listed a compensation of 62 hour.

The 50-mile radius is a policy set by the. Home Health Hospice House Supervisor ICU Imaging IMCU 19 Infectious Disease Infusion Intermediate Care Unit Interventional Radiology Intravenous Therapy IR19 IV Ther Lab Tech Labor Delivery. Yes if you are itinerant your home is wherever you are just as with most ordinary employees.

Our members represent more than 60 professional nursing specialties. Tax-Free Stipends for Housing Meals Incidentals. For this to apply however the travel nurse must meet 2 out of 3 of the following criteria.

The costs of your uniforms including dry cleaning and laundry costs. Our mission is to Empower Unite and Advance every nurse student and educator. Know the rules and exceptions.

Dont live your life around a tax deduction. A tax home goes another step further. Travel Nurse Tax Deduction 1.

Apr 18 2014. Understanding Travel Nursing Tax Rules. 2021 has been a unique year for travel nurses and some.

This can be a house apartment or a rented room but you need to keep evidence of the regular expenses you incur in maintaining the property or arrangement.

Taxes On A Home Can Be Confusing Here S How To Keep Them Straight

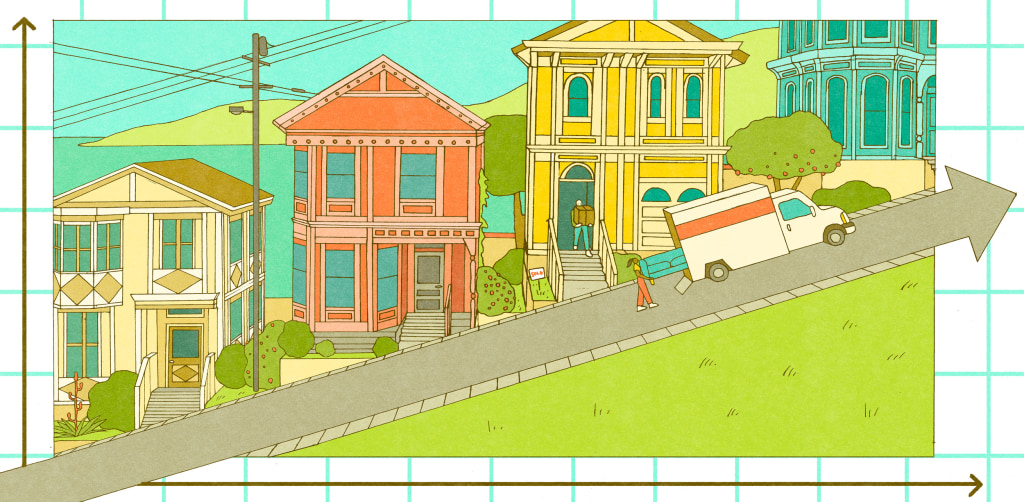

Bidding Wars And Meaningless List Prices Buying A House In The Bay Area

:max_bytes(150000):strip_icc()/flower-box-porch-railing-Getty-Images-Perry-Mastrovito-daaafffb11ed46d0ae9c9bf46b0a4a44.jpg)

Reverse Mortgage What It Is And How To Get One

How Much Rent Do I Need To Pay Tax Home Q A For The Travel Nurse Therapist Tech By Nomadicare Medium

18 Habits That Are Keeping You Broke My Jearney Budgeting Money Habits Budget Planning

Home Town Season Six The Hanna House Laurel Mercantile Co

Ask A Travel Nurse Can I Rent Out My Tax Home The Gypsy Nurse

How To Keep Your House If You Need Nursing Home Care Landskind Ricaforte Law Group P C

How Much Rent Do I Need To Pay Tax Home Q A For The Travel Nurse Therapist Tech By Nomadicare Medium

What Really Is A Tax Home As A Travel Nurse While On Assignment

Amazon Com Large Welcome Home Banner Flower Cluster Welcome Banner Yard Sign Decoration Spring Summer Fall Winter Floral Welcome Home Garland Hanging Photo Booth Background For Home Outdoor Outside Party Decor Home

Habitat For Humanity Of Martin County Our Families

Tales Of A Puget Sound Housing Market Gone Amok Puget Sound Business Journal

65 Rockledge Drive Pelham Ny 10803 Zillow

Letter Of Explanation For A Mortgage Bankrate

Here Are The Most Expensive Homes For Sale In North Carolina Cbs 17

Demand Rises Among Seniors To Rent Rather Than Own In Active Adult Communities The Washington Post

Buying A House Without Your Spouse Community Property Edition Quicken Loans